FAQ

Because Canadian rules require a minimum down payment, it might be difficult to purchase a property without making any down payment. Though this is less usual and has certain qualifying requirements, some programs or deals, such as the “Flex Down” scheme, enable you to borrow the down payment via a loan or line of credit.

No, using a realtor is not required when purchasing a property, but many people find that it helps with paperwork, price negotiations, and market navigation. The skills and experience of a realtor may make the purchasing process easier. You expose yourself to many risks by representing yourself.

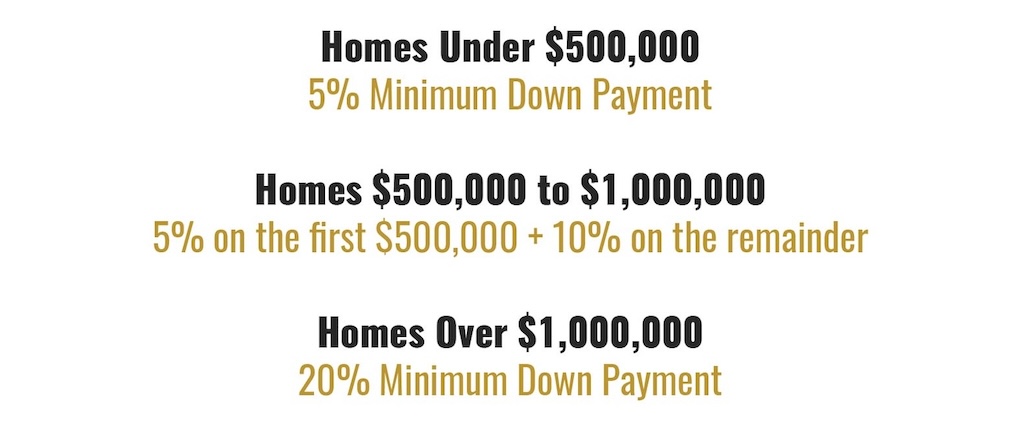

For properties under $500,000, you should set aside a minimum of 5% of the purchase price as a down payment. For homes over $500,000, you’ll need 5% for the first $500,000 and 10% for the portion above. It’s also advised to set aside extra money for emergency savings and closing charges, which should account for 1.5% to 4% of the buying price.

Yes, but a ban on non-residents buying existing homes is in place until 2025, which may be extended to 2027. Although there are limitations on buying existing residences, foreigners interested in development or possessing work permits may purchase real estate in Canada.

The new rule in Canada extends the ban on home purchases by foreigners up to January 1, 2027. Initially set by Prime Minister Justin Trudeau’s government to expire on January 1, 2025, this measure aims to improve housing affordability for Canadians by limiting competition from non-Canadian buyers.

In 2023, to afford a home in Canada’s expensive cities, you needed approximately over $200,000 CAD annually. Specifically, in Vancouver, the required income was about $237,000 CAD.

Do research on the neighbourhood market, determine the seller’s intentions, provide a fair offer based on similar sales, and be prepared to compromise on certain things. When negotiating, working with a competent realtor is helpful as there are many risks to being a self-represented buyer.

Yes, as we mentioned above this ban is extended to January 1, 2027.

The Land Transfer Tax in Ontario must be paid; the amount varies based on the cost of the house. Certain cities such as Toronto will also have municipal land transfer taxes too.

Expect closing costs (lawyer fees, land transfer tax, adjustments), moving expenses, home insurance, property taxes, maintenance costs, and possible condo or association fees.